Climate change is already costing us hundreds of pounds each year. Most don’t even notice

How long before we do? - Story 80

Most people in Britain accept that climate change is real. Far fewer have altered their behaviour in response. I was like that.

That gap — between awareness and action — is one of the defining challenges of our era. The science even the scale may feel abstract.

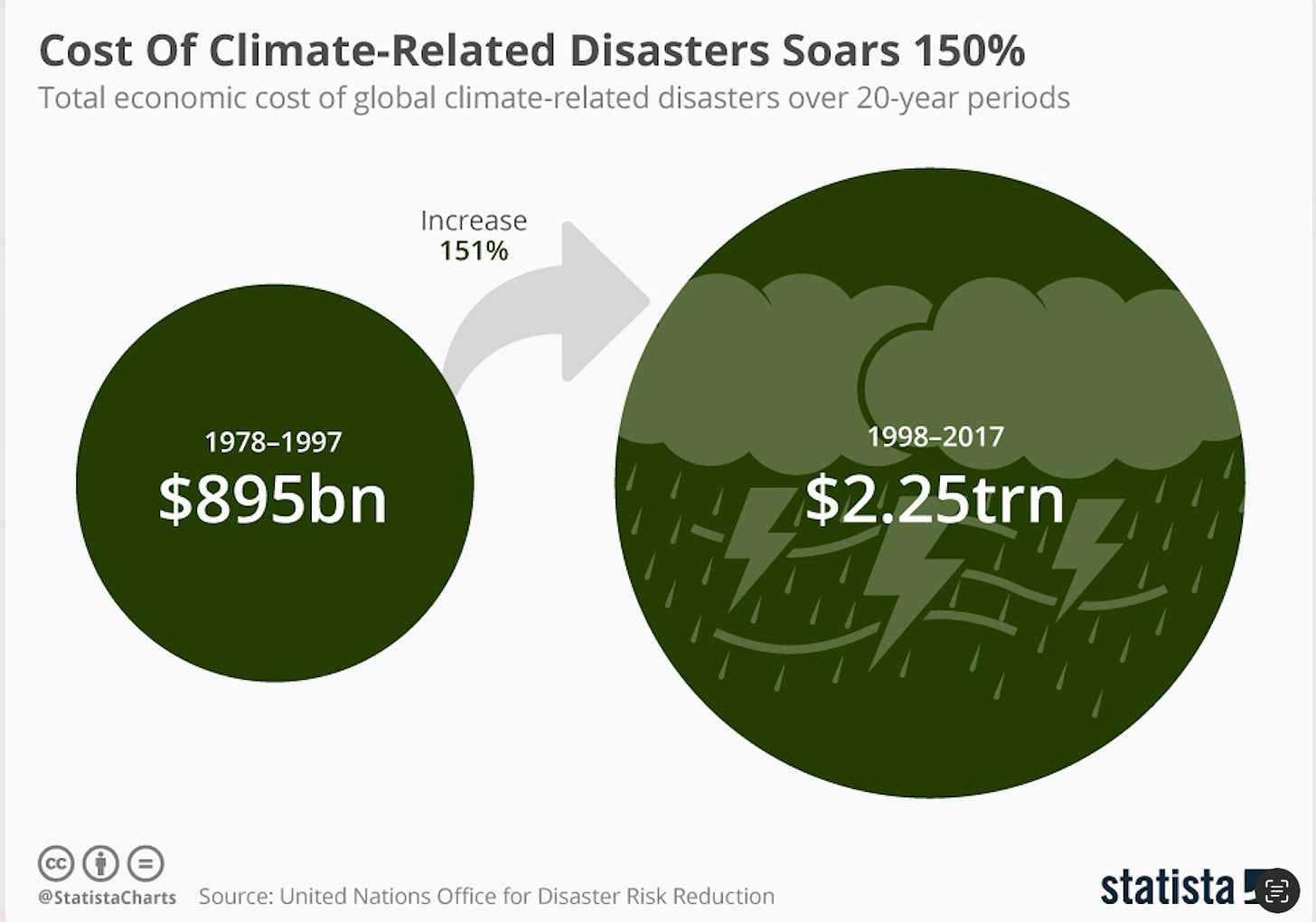

How do you make sense of trillions of dollars? Well, the economics are starting to get personal.

Annual reminders, subtle shifts

Take home insurance — the type of policy most people review once a year, grumbling at renewal notices before clicking “auto-renew.” Yet these annual reminders may soon become something more: a signal that climate change is no longer a distant threat but a line item on the household budget.

Today, more UK homes are at risk of flooding than of burglary. That’s not a forecast: it’s a fact. According to government figures, about one in six properties (over five million in total) face some form of flood risk, whether from rivers, coastal surges or surface water.

In some areas, the impact is already biting. Tenbury Wells, a small Worcestershire town hit by repeated flooding, was singled out late last year as potentially the first British high street to be abandoned due to climate change. The reason? Shop owners can no longer afford insurance.

To shield homeowners from these growing risks, the government in 2015 launched Flood Re, a reinsurance scheme designed to keep cover affordable for the most vulnerable. But as climate volatility increases, such state-backed interventions may become more common echoing the United States, where federal insurance props up property markets in New Orleans LA, Florida Keys, Galveston TX and Staten Island NY.

Retirement planning meet warming planet

The process of securing home insurnace forces you to think about this cost annually. Pension planning is different.

If home insurance provides an annual jolt, pensions unfold more slowly. But the financial implications of climate change may be even more profound.

About a third of British adults report actively planning for retirement, according to data from My Pension Expert. For many, this represents the largest single investment of their lives — and one especially sensitive to long-term shifts in global markets.

Pension funds, unlike politicians, do not deal in vibes. They track financial performance including risks. And as climate-related disruptions ripple through food production, property markets and infrastructure, the costs will increasingly show up in balance sheets and long-term returns.

The message is not that pensions are at imminent risk but that the assumptions underpinning them may need revisiting. A warmer world could mean lower returns, higher contribution requirements, or both.

How much extra are we paying already?

A recent report by the environmental think tank Green Alliance attempts to quantify the everyday costs Britons are already absorbing. It estimates that the average household is paying more than £42 annually in additional home insurance premiums due to ‘nature loss and climate impacts’.

The bigger surprise is food. The report suggests climate change is already adding £180 a year — or roughly £3 per week — to the average family’s grocery bill. That may not sound dramatic. In Barnes or Mortlake, £3 is less than the cost of a flat white.

But recall, the recent political row over the UK Winter Fuel Payment centred on a tax-free annual sum of £200 for pensions under the age of 80.

Of course the bigger question is not whether the costs will continue to rise. They will. The question is when enough of us will feel them — and care enough to act.